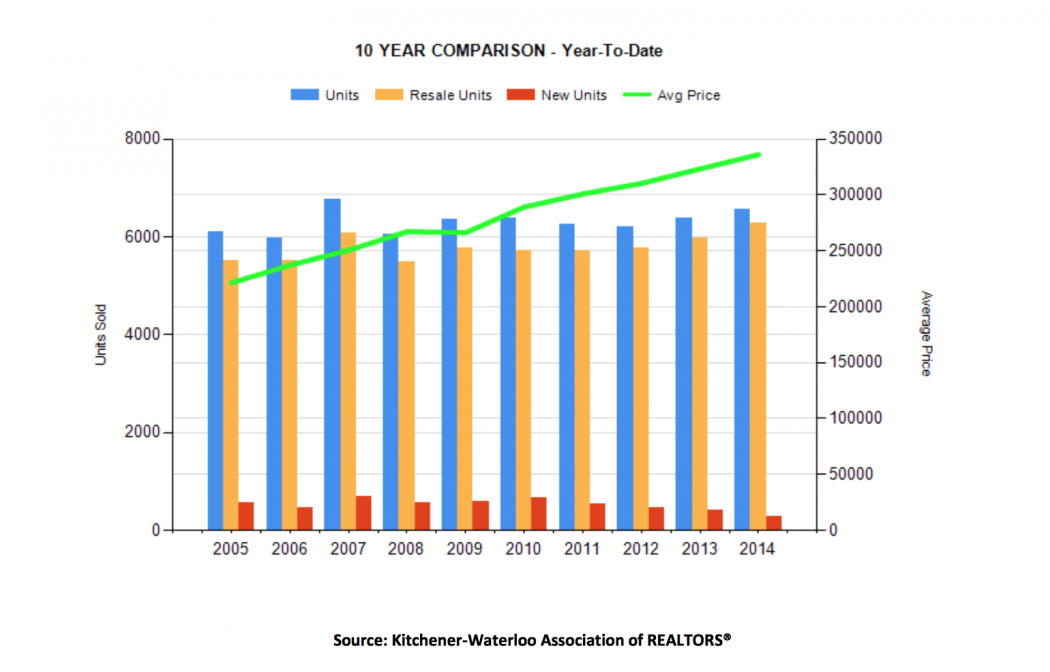

The 2015 outlook for the Kitchener Waterloo real estate market can be summed up as follows. We have a stable local real estate market due to our diverse economy, growing tech sector, transportation infrastructure and new investment into the region. In 2014, we experienced a 3% increase in the number of homes sold as well as a 4% increase in home prices in Kitchener Waterloo. We expect our moderate growth to be sustainable and continue into 2015.

Highlights from Kitchener Waterloo Association of Realtors:

Highlights from Kitchener Waterloo Association of Realtors:

1) The average sale price of all residential sales in 2014 increased 4% to $336,302 in comparison to 2013.

2) Single detached homes sold for an average price of $382,798 (up 4.3%).

3) Semi-detached homes sold for $256,606 (up 2.9%).

4) Townhouses sold for an average of$287,951 (up to 3.4%)

5) Condominiums sold for an average of $222,359 (up 2.5%).

Bubble? What bubble?

For the past few years I’ve been hearing that Canada’s house prices are over valued by as much as 20% or even 30%. Furthermore, household debt has never been higher. Of course, since real estate accounts for the majority of the assets held by Canadians the two are linked. But the economy is very complex. Canadian banks are quite conservative. Our lenders know what they are doing. The Bank of Canada, our Finance Minister and The Canadian Housing and Mortgage Commission have been tinkering with the controls, making it harder for investors (which is good) and first-time homebuyers (which is bad – it’s hard enough already). The news media have been crying wolf for years – there’s going to be a crash, there’s going to be a crash. And procrastinating potential home buyers have been waiting in vain for prices to drop, but they haven’t dropped. Home prices haven’t dropped by 20% – they went up again last year – in KW by 4.3% for a single detached home.

Photo Credit