The Ontario Liberal government is not ruling out giving Ontario’s municipal governments the option to impose a municipal land transfer tax. This is bad news for home buyers. A municipal level land transfer tax (MLTT) could add several thousand dollars to an already pricey purchase.

According to Municipal Affairs Minister Ted McMeekin, “everything is on the table as cash-starved municipalities cast about for ways to raise money”. This potential new tax is a result of proposed changes to the Municipal Act. Of course, it will be up to individual municipalities to decide whether or not to implement a local level Land Transfer Tax (LTT).

“Ontario home buyers are already charged a provincial land transfer tax, so by adding a municipal tax, they’re essentially doubling the tax burden on Ontario families,” said Patricia Verge, president of OREA. “If the Ontario Liberals follow through with this plan, home buyers will be forced to pay $10,000 in total land transfer taxes on the average priced home in Ontario, starting as early as next year.”

What will it cost?

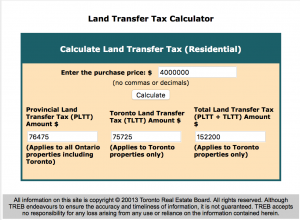

In Waterloo Region, the average price for a home is about $380,000. For the sake of round numbers, let’s round it up to $400,000. Here’s what it might cost. (click to enlarge)

How the Land Transfer Tax is calculated?

The LTT is calculated on a sliding scale. There are lots of LTT calculators online, but here is how the Ontario Land Transfer Tax is calculated:

.5% on amounts up to and including $55,000

1% on amounts exceeding $55,000 up to and including $250,000

1.5% on amounts exceeding $250,000

2% on amounts exceeding $400,000

The buyer pays the tax, not the seller.

Public consultations

According to an Ipsos Reid poll, the majority of Ontario residents outside Toronto (89%) appose this tax. If a new tax were to be put into place, the majority of respondents said that:

It would limit their ability to afford a home (77%)

They would have to delay their home purchase (75%)

The provincial government is currently seeking public consultation on changes to the Municipal Act. We can stop the tax. Take action now. Say NO to another home owner tax.

The effect of the tax

Our current provincial Land Transfer Tax has been in place since 1989. Real estate values really slumped in the early 90’s and home prices took most of the rest of the decade to return to early 90’s levels. Are these two events related? Probably not. Maybe?

Municipal Land Transfer taxes in Ontario however are new. Toronto put its in place in 2008. According to OREA (the Ontario Association of Realtors), “Over five years following, it is estimated that 38,227 housing transactions did not occur in Toronto because of the MLTT. With every home transaction generating $55,000 in consumer spending on things like renovations, furniture, appliances, and fees to professionals, the MLTT has cost the City of Toronto $2.3 billion in lost economic activity and 15,000 jobs”.